The Tether Conundrum Part 2: The Plot Thickens

NOTE: For more background including a brief introduction to Tether itself, see part 1 of this series: The Tether Conundrum: A Quick Backstory. This post will largely assume you have read that first, or are at least familiar with the material it covers. Also thanks to Bitfinex'ed for surfacing much of the material covered in this post.

There have been plenty of developments surrounding Tether in the months since I wrote the first post in this series in January:

- Tether’s previous “auditor” (who never completed an audit), Friedman LLP, removed all mentions of Tether from their web site. Shortly thereafter Tether would announce that they are dissolving their relationship with Friedman. Despite claims of “frequent professional audits” on their web site, to date Tether has never completed an audit.

- The US Commodity Futures Trading Commission (CFTC) sent subpoenas to Bitfinex and Tether and subsequently denied a freedom of information act (FOIA) request to obtain them citing what the linked CoinDesk article described “a number of exemptions in denying the request, including one commonly applied to law enforcement investigations”. That said, some public statements made by the CFTC give us a glimpse into how Tether may have manipulated Bitcoin’s price.

- A study based on statistical methods called Is Bitcoin Really Un-Tethered? suggests Tether was used to manipulate Bitcoin’s price, lending credence to the speculation which I covered in my previous blog post on Tether. Their conclusions are certainly not a slam dunk, but are at least vast and rigorous, certainly more so than mere speculation alone.

- Bitfinex’s Chief Strategy Officer resigned citing concerns that as a US citizen, Tether leaving the US is not aligned with his interests. This despite the fact that Tether recently switched to a bank located in Puerto Rico. More on that below.

- Tether issued an additional $1.3 billion worth of USDT tokens (including $250 million a day before this post was written), bringing the total outstanding issuance (i.e. what they claim to have backed 1:1 in their bank accounts) to over $3 billion.

Perhaps most notably, however, Tether published a new “proof of funds” on their web site, hiring a new law firm to conduct a random spot check of the balances of their two banks. The contents of this latest audit-not-audit, and the people involved, are the primary topics I’ll be covering in this post.

The contents of this new “proof-of-funds” letter were quite similar to the previous “proof-of-funds” letter one originally published by Friedman LLC:

- The letter is not an audit, but privileged attorney-client correspondence which Tether chose to publish to the world containing a point-in-time balance check. The firm in question “randomly” selected the date of June 1st and obtained balance information from employees of Tether’s banks.

- The letter does not cover the source of the alleged funds, i.e. we have no idea if they were legitimately obtained or e.g. the proceeds of crime.

- Additionally notable is that Tether’s liabilities are not covered, i.e. we have no idea if this money is merely borrowed and Tether is actually in the red.

There are several other concerns about this particular letter, but if we do just want to look at it as a point-in-time confirmation of funds, there are reasons why we might give it credence.

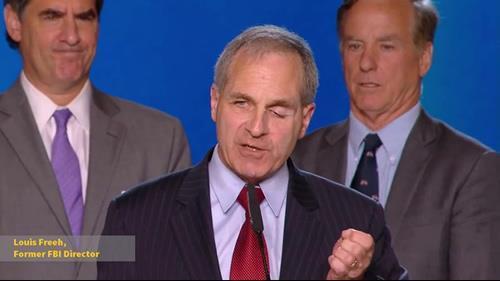

The letter was produced by Freeh Sporkin & Sullivan, LLP (FSS), whose partners are former FBI director Louis Freeh and two former federal judges including Eugene R. Sullivan, which the Tether “proof-of-funds” letter cites as their connection for discovering the law firm in the first place.

While there are many reasons to have doubts about Tether’s latest audit-not-audit, the word of a law form consisting former FBI federal director and former federal judge (actually two federal judges, although I’ll only be discussing one of them) is not something to be dismissed lightly.

This post unfortunately contains no hard evidence that what they’re saying is incorrect. I hope it will, however, raise many concerns about this firm’s credibility, including multiple conflicts of interest between them, Tether/Bitfinex, and at least one of Tether’s banks which is likely to have been the subject of the audit-not-audit.

Entangling Relationships #

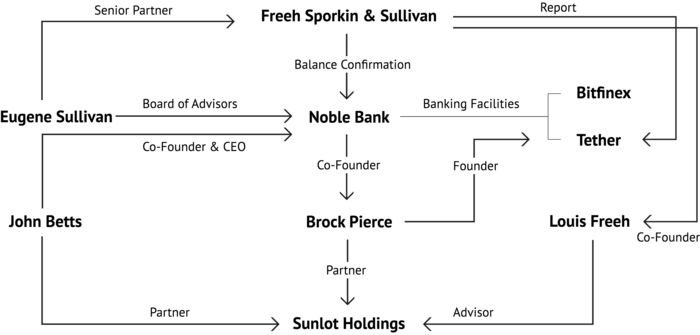

From Diar’s “Tether Hits $3Bn Outstanding Following Solvency Report”

In the week since the FSS “proof-of-funds” has been published, Tether’s skeptics (notably Bitfinex'ed) have discovered a number of suspicious relationships between individuals involved in the firm, Bitfinex/Tether (they are effectively the same company), one of Tether’s banks, and other things in the cryptocurrency world including the infamous and maligned MtGOX Bitcoin exchange.

The bank which is central to this post is Noble Bank International, recently formed in Puerto Rico, which a recent Bloomberg article highlighted as being Tether’s new bank. As we’ll see, Noble has direct connections to both Tether and FSS.

The rest of this post will highlight each of the notable individuals which play a major part of this story and attempt to convince you there are conflicts-of-interests and a long history of suspicious behavior.

About Eugene Sullivan #

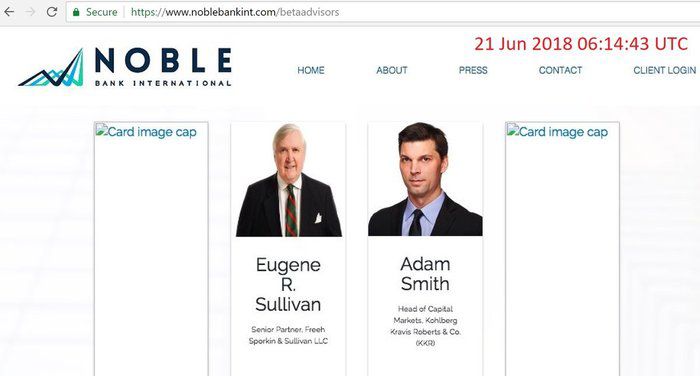

The above image is taken from Bitfinexed’s Twitter feed and contains an alleged screenshot of a page which briefly appeared on Noble’s web site before being removed. At least as of the time of writing this post the contents of this page still appear in Google search results (but unfortunately, it was not completely snapshotted by archive.org):

Eugene Sullivan is a retired federal judge who is now a partner at the FSS law firm. He is particularly notable because he’s named directly in the “proof-of-funds” letter:

Judge Eugene R. Sullivan (Ret.), one of the partners, is a member of the advisory board of one of Tether’s banks. It was through this connection that Tether was introduced to FSS. As well, the firm’s relationship with the bank allowed for the following review to commence in a timely and comprehensive manner, ensuring that no pertinent information was overlooked in the process.

Based on this admission, the evidence in the Bloomberg article, and the information posted (and removed) from Noble’s web site, it appears there’s a strong case that Noble is one of the two unnamed banks in the report. It also seems like quite a conflict of interest for a law firm to make assertions like this about a bank one of their partners advises, but stay tuned, because there are more COIs with Noble to come.

Are there any other reasons to be suspicious of Judge Eugene? Well, he also happens to be non-executive director of Imperial Pacific International Holdings, the holding company for casinos which were recently built in Saipan (a U.S. Pacific island which is home to 50,000 people) called Imperial Pacific Resort (formerly the Grand Mariana) and Best Sunshine Live:

Though not directly connected to the rest of the Tether story (at least as far as I presently know), the casinos are notable for recently being raided by U.S. agents due to the suspiciously high volumes of money passing through them:

Imperial Pacific has attracted broad attention in the gaming industry for the volumes being recorded at its Saipan casino, which are far larger on a per-table basis than those at the grandest resorts in Macau.

A Bloomberg article describes Best Sunshine Live as “the most successful casino of all time”. Another Bloomberg article described Imperial Pacific International Holdings as an “impossibly lucrative gambling operation” and a “back door to the U.S financial system”.

About Louis Freeh #

Louis Freeh has a long and sordid history for which he was practically infamous. During his tenure as FBI director he championed the Carnivore program designed for electronic surveillance, and also pushed for law enforcement access to encryption keys. He also participated in a coverup of the government’s actions during the Waco siege.

For these reasons a BusinessWeek article written in the year 2000 entitled “The Case Against Louis Freeh” called for his resignation. In 2001 he resigned in disgrace amidst multiple scandals, including the espionage scandal surrounding Robert Hanssen.

A web site (and corresponding Twitter account) called Fact Freeh chronicles his past including his many exploits since entering the private sector. There’s far too much for me to cover here, but I encourage you to check it out.

There is a story you might be familiar with which I’d like to highlight in particular though: Freeh is connected to two companies involved in purchasing MtGOX after it was hacked: Freeh Group International Solutions and Sunlot Holdings. The latter would eventually take over the beleaguered exchange, and was founded by another person of interest: Brock Pierce.

About Brock Pierce #

Brock Pierce is quite the guy, and I mean that in the most disrespectful way possible. You might (extremely hazily) remember him from The Mighty Ducks, where in a flashback he plays a younger version of the coach of the eponymous team.

In 1999 in the midst of the Dot Com bubble at the age of 17, he cofounded Digital Entertainment Network, an online media startup promising to deliver original video content in the age of dialup.

After taking $26 million in funding and preparing for a $75 million IPO, the company collapsed amidst allegations that he and his co-founder Marc Collins-Rector raped young boys who were supposed to appear in the company’s videos after threatening them at gunpoint. Brock and his other cofounders fled to Spain to escape prosecution.

The allegations resurfaced in 2014 when he was appointed to the board of the Bitcoin foundation, in addition to allegations that child pornography was found in a Spanish residence in which he and his partners were staying. Brock denies any wrongdoing.

In regard to this particular story, Brock Pierce is notable for two reasons:

- He is the co-founder of Tether (as can be verified by his LinkedIn profile and many other public sources including his Twitter profile)

- He is the co-founder of Noble Markets. Noble Markets is the parent company of Noble Bank International, as mentioned on Noble Bank’s web site.

In other words: Tether’s alleged bank Noble is owned by a company that Tether’s co-founder also co-founded.

Curiously, FSS claims Tether discovered them because Eugene Sullivan sits on their board. But it seems they weren’t entirely forthcoming about all of the relationships involved.

Conclusion #

I wish there were a smoking gun which could conclusively demonstrate wrongdoing on Tether’s part. We don’t have that, and at face value we have the word of a law firm run by a former FBI director and two retired federal judges. Descriptions like that gloss over the many details of the individuals involved though.

I have seen many people concluding from the latest audit-not-audit and the authority of an FBI director and retired federal judges that Tether is on the up-and-up. I think such conclusions are premature. The FOIA request the CFTC denied seems to point to an active and ongoing investigation, and there are far too many conflicts of interest happening here to take the “proof-of-funds” at face value.

As far as I’m concerned, this whole thing stinks to high heaven. But only time will tell.